It looks like a last-ditch effort meant for yesterday’s market.Ī ShiftPixy subsidiary is sponsoring the SPACs, all of which filed updated draft prospectuses dated Tuesday showing reduced target sizes.

#Shift pixy stock software

ShiftPixy (PIXY.O), a listed temporary-employment software provider with a market capitalization of $40 million, has cut the fundraising target for four blank-check vehicles it is backing.

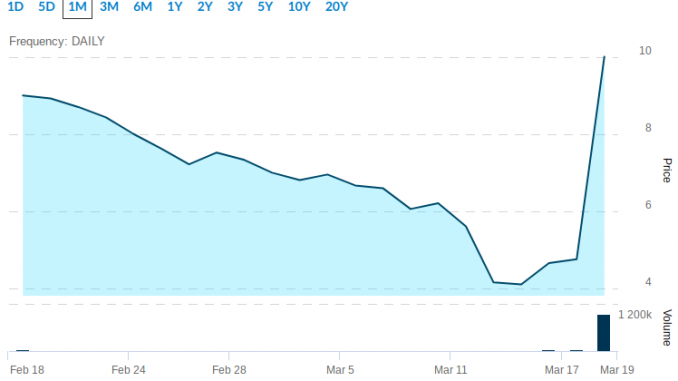

At least one sponsor of special-purpose acquisition companies is hoping they still are. NEW YORK, Aug 25 (Reuters Breakingviews) - SPAC investors were indiscriminate at the beginning of 2021. On the date of publication, Samuel O’Brient did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the Publishing Guidelines. Read More: Penny Stocks - How to Profit Without Getting Scammed If we ever do publish commentary on a low-volume stock that may be affected by our commentary, we demand that ’s writers disclose this fact and warn readers of the risks. That’s because these “penny stocks” are frequently the playground for scam artists and market manipulators. On Penny Stocks and Low-Volume Stocks: With only the rarest exceptions, InvestorPlace does not publish commentary about companies that have a market cap of less than $100 million or trade less than 100,000 shares each day. The case of PIXY stock’s surge today won’t be any different. When interest passes, shares fall as quickly as they rose. Penny stocks often rise on quick announcements that spike social media attention. While it’s impossible not to be excited when a stock surges 180% in a few hours, investors must carefully assess the bigger picture. Today is an example of another superficial catalyst that won’t generate any sustainable growth for PIXY stock. Even SwiftPixy’s venture into the non-fungible token (NFT) space failed to push it up while NFT interest was skyrocketing. As a result, it quickly fell and hasn’t seen real growth since. PIXY failed to garner meme-stock status when it had some investor’s attention. It rose early in 2022 on high short interest, but those flash-in-the-pan catalysts don’t keep a stock up for long. A microcap stock that hasn’t traded at more than $1 per share since February 2022, PIXY has little to excite investors in the long-term. If it does not conclude successfully, SwiftPixy will stop operations with AXH, rendering AXH stock worthless.Īs much as PIXY stock has surged today, its gains are about to stabilize. The company notes there is no guarantee of AXH’s initial business combination. While the special share distribution’s approval is good news for PIXY stock investors, it is not a complete deal.

No fractional shares will be issued as part of the initiative and “no distributions will be made in lieu of fractional shares.” While there is currently no set distribution date, ShiftPixy notes that it will happen following the initial business combination of AXH. In sum, all investors who hold PIXY as of next week will receive the same percentage of AXH stock. The statement goes on, “the exact number of shares of AXH common stock to be received by ShiftPixy shareholders for each share of ShiftPixy common stock will be determined immediately before the record date based on the number of shares of ShiftPixy common stock outstanding on an as-converted and as-exercised basis.”

#Shift pixy stock pro

A statement released by the company lays out the following: “All ShiftPixy shareholders of record as of May 17, 2022, will receive their pro rata share of AXH common stock equal in proportion to their percentage holdings of ShiftPixy common stock issued and outstanding.” Today, ShiftPixy announced that its board of directors had approved a special share distribution initiative for PIXY shareholders. Let’s take a closer look at what’s going on. But while PIXY stock is skyrocketing today, AXH is falling quickly. ShiftPixy has a roughly 15% ownership stake in the blank-check firm. Today’s news also involves Industrial Human Capital (NYSE: AXH), a special purpose acquisition company (SPAC).

As of this writing, PIXY stock is up 185% after the company announced a special share distribution for stockholders. Staffing software producer ShiftPixy (NASDAQ: PIXY) is enjoying a day of significant growth.

0 kommentar(er)

0 kommentar(er)